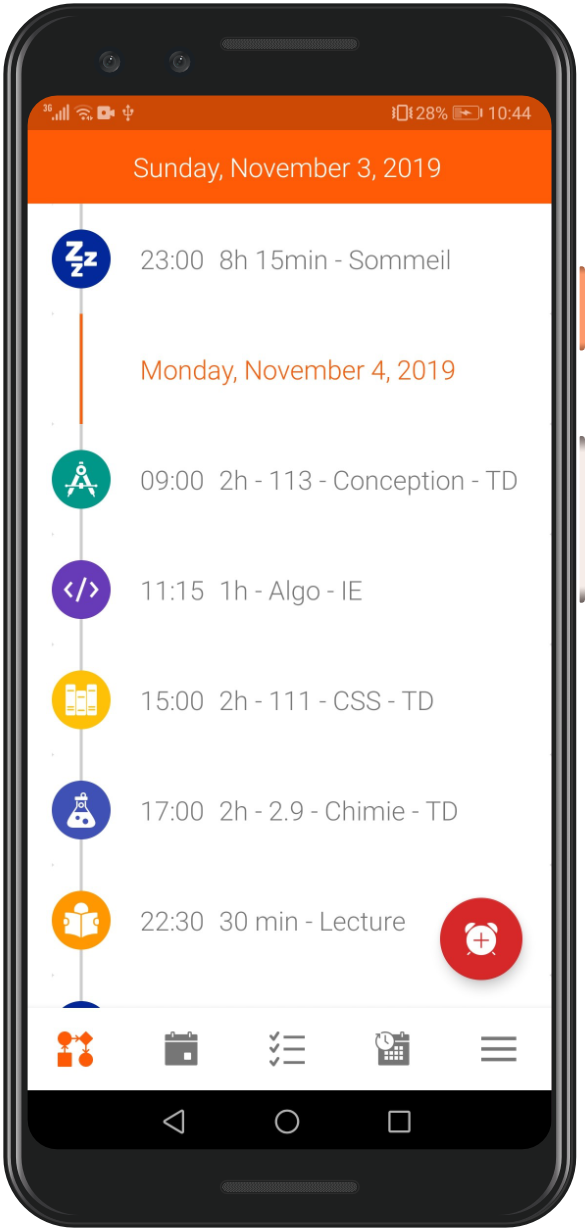

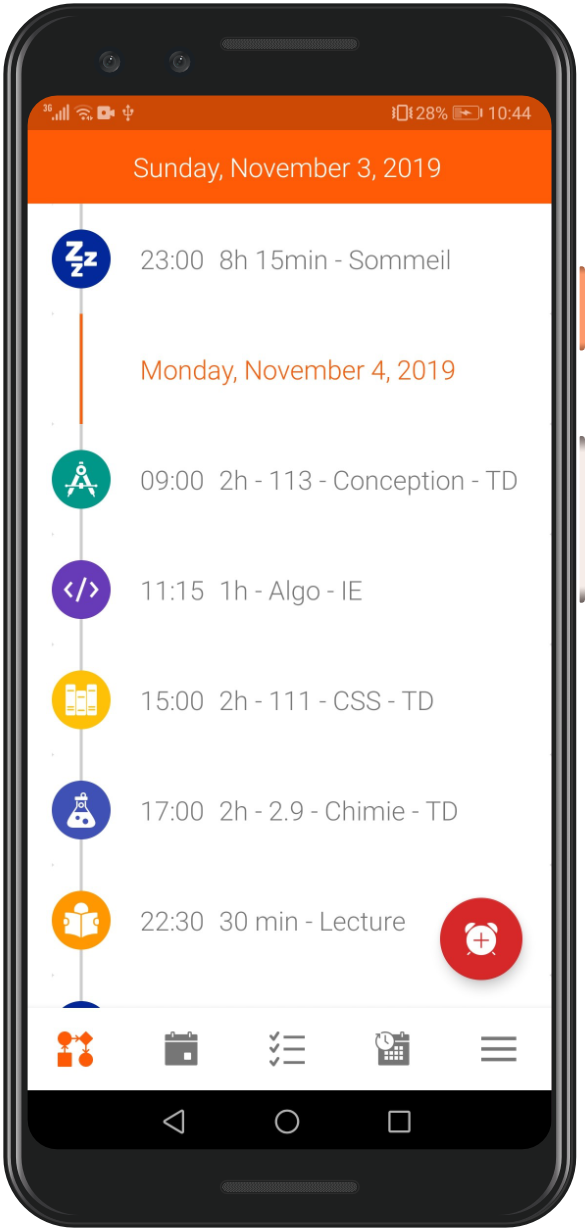

Invest in TimePlanner and support french innovations

Trust our team and our ideas by investing in our french start-up. Become a full member of the company and participate in our investors events presenting our quarterly results and forecasts. By choosing to invest in TimePlanner, you support a company committed to innovation and social well-being. Contact our investment department >

Strong growth

TimePlanner thinks big and its growth is strong. Our forecasts are bright in an era

of digital tools are becoming essentials.

Exciting and intelligent

Building TimePlanner and implant it on the international market is a real adventure,

both exciting and intelligence consuming.

Reduce your taxation

Investing in TimePlanner could help you to reduce your taxation by using french tax

benefits on revenue taxes. Feel free to contact our investment department.

Get tax benefits

By investing in TimePlanner you benefit from large tax breaks. In particular, 18% of the amount invested is deductible from your income tax, up to a limit of 12,000 € for a single person or 24,000 € for a married couple or linked by the "Pacs". In addition, with the flat-tax of 30% on the capital gains, your taxes on the income generated by your investment are considerably reduced. In addition, if you opt for a PEA-SME securities account you are exempt from taxes on the income generated by your investment in TimePlanner. Contact our investment department >